Homeowners Insurance in and around Topeka

A good neighbor helps you insure your home with State Farm.

Help cover your home

Would you like to create a personalized homeowners quote?

With State Farm's Insurance, You Are Home

Investing in homeownership is an exciting time. You need to consider home layout your future needs and more. But once you find the perfect place to call home, you also need great insurance. Finding the right coverage can help your Topeka home be a sweet place to be.

A good neighbor helps you insure your home with State Farm.

Help cover your home

State Farm Can Cover Your Home, Too

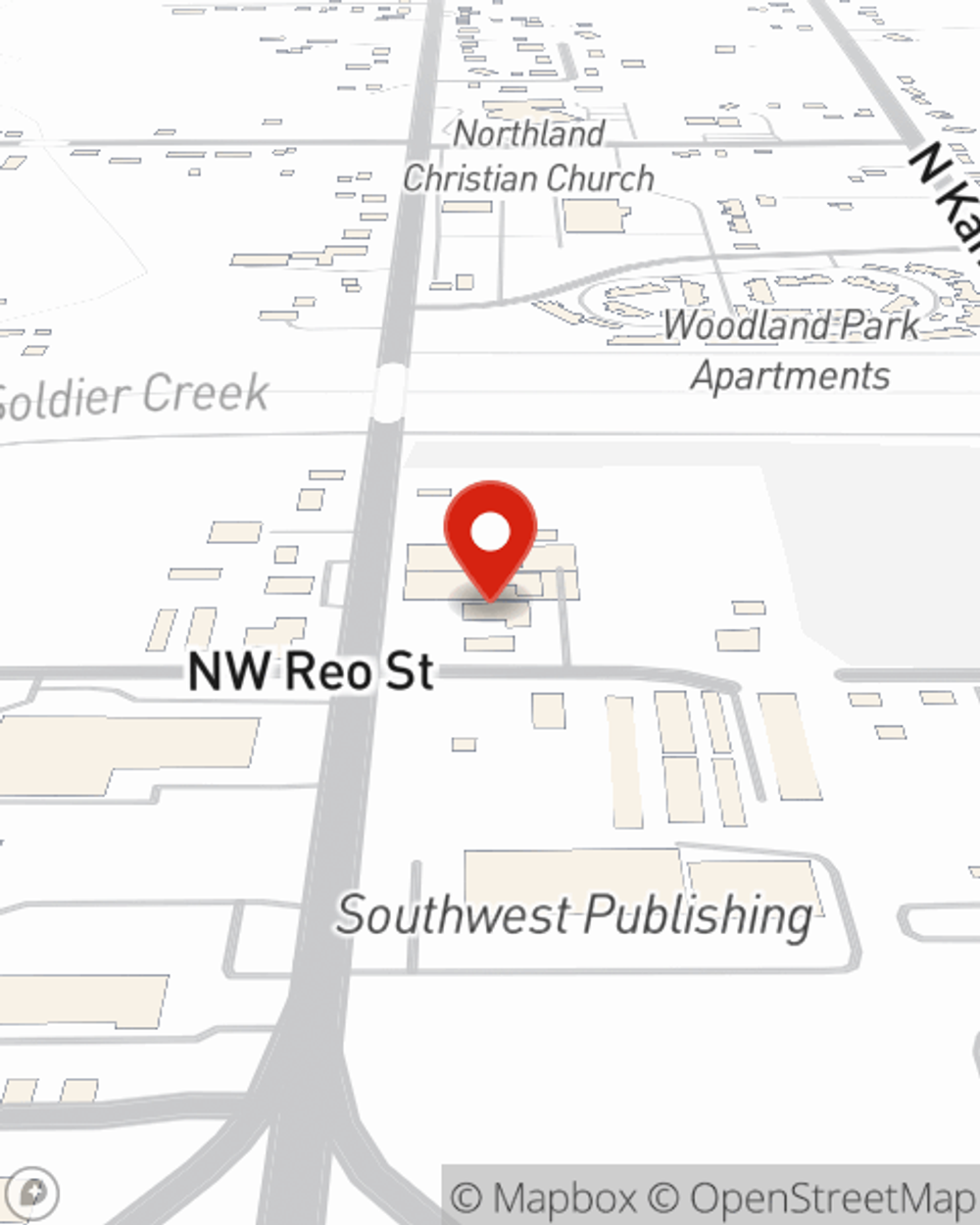

For insurance that can help cover both your home and your belongings, State Farm has options. Agent Jamie Hornbaker's team is happy to help you set up a policy today!

Remarkable homeowners insurance is not hard to come by at State Farm. Before the unforeseeable transpires, visit agent Jamie Hornbaker's office to help you get the home coverage you need.

Have More Questions About Homeowners Insurance?

Call Jamie at (785) 235-5633 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to clean gutters and downspouts safely

How to clean gutters and downspouts safely

Regular gutter cleaning may help you avoid expensive repairs to your home and yard. Learn how to clean gutters safely.

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.

Jamie Hornbaker

State Farm® Insurance AgentSimple Insights®

How to clean gutters and downspouts safely

How to clean gutters and downspouts safely

Regular gutter cleaning may help you avoid expensive repairs to your home and yard. Learn how to clean gutters safely.

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.